The Week That Was & The Week that’s Ahead

Calisade Capital is an asset management firm that delivers institutional advisory services and weekly insights to the retail market via its Calisade Digests. Calisade focuses on creating alpha through robust macro, fundamental, technical, and sentiment research.

September opened with investors caught between weakening labor data, political turbulence around the Federal Reserve, and anticipation of critical inflation releases. The shortened first week of the month was marked by mixed earnings, soft hiring signals, and heightened expectations that the Fed will move toward a September rate cut. Yet as traders digested these developments, focus quickly shifted to the week ahead, where fresh CPI and PPI prints, consumer sentiment surveys, and budget data will test whether markets are ready to sustain a rally or brace for renewed volatility.

The Week That Was (September 1 to September 5, 2025)

The first week of September delivered a mix of cautious optimism and political unease as investors navigated softening labor data, signs of manufacturing weakness, and renewed concerns over Federal Reserve independence. Equity markets ended higher, supported by growing conviction that the Fed will cut rates this month. Still, volatility remained a constant undercurrent as earnings updates, fragile economic signals, and political developments shaped sentiment heading into a pivotal stretch for monetary policy.

Market Sentiment & Tone

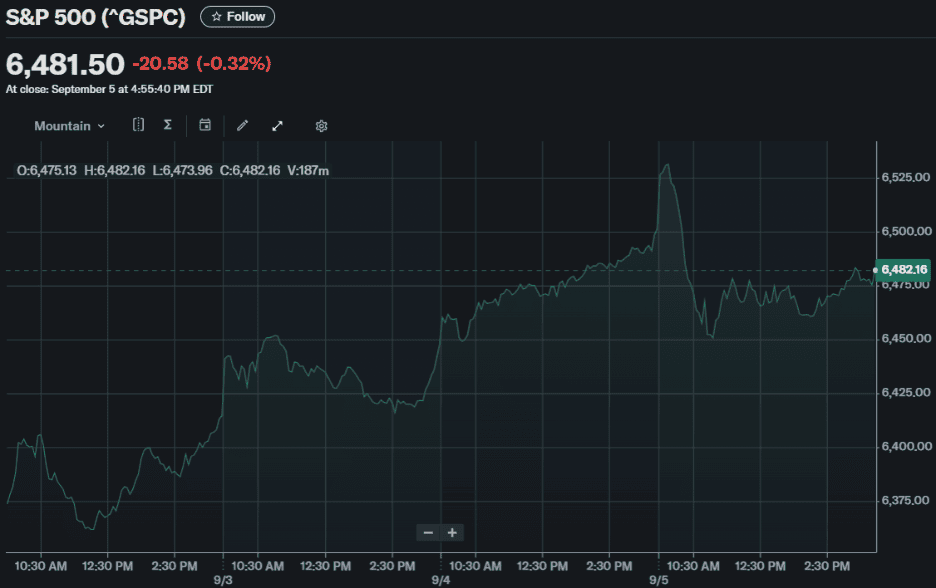

Markets entered September cautiously, weighed down by uncertainty around Fed independence, looming jobs data, and global political risks. Setting the stage for a volatile finish to the summer. The S&P 500 rose by 1.24% over the week, while the Nasdaq led gains with a 2.74% rise, reflecting tentative optimism as investors positioned for a likely Fed rate cut.

Labor Day Quietude

The week began on a subdued note as U.S. markets remained closed on Monday, September 1 for the Labor Day holiday. With no trading activity to set the tone, investors entered September focused on upcoming economic reports and political headlines, keeping risk appetite contained at the outset.

Manufacturing & ISM Data

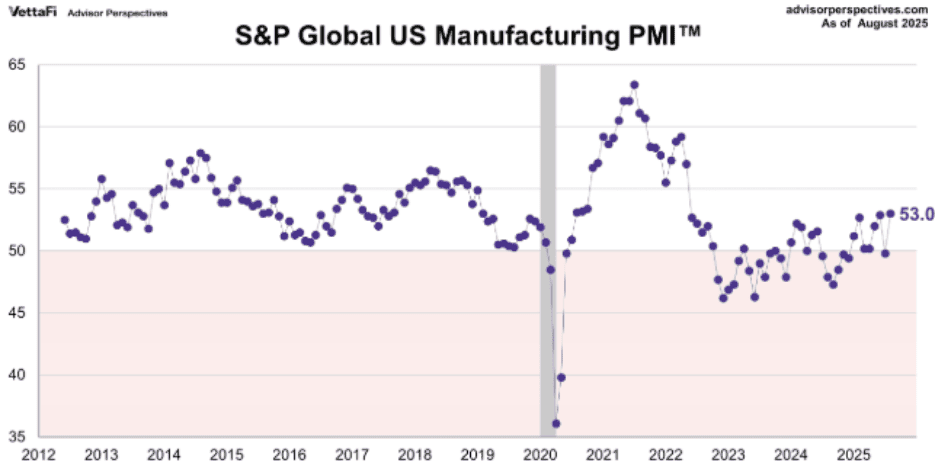

Fresh manufacturing data provided an early test for market sentiment. On September 2, S&P Global’s final manufacturing PMI slipped to 53.0 from 53.3, while the ISM manufacturing index came in at 48.7, signaling contraction in factory activity. The divergence reinforced a picture of resilience in some private-sector readings but persistent weakness in broader industry output, adding to concerns that U.S. growth momentum is softening.

Softening Labor Metrics & Fed Signals

Labor market signals added to the dovish tilt in investor expectations. The ADP report showed just 54,000 private sector jobs created in August, far below consensus forecasts. Traders quickly priced in a near certainty of a September rate cut, with probabilities rising to 97.6% unless the nonfarm payrolls report delivered a major upside surprise above 140,000 to 150,000. The weak hiring data underscored a cooling labor backdrop that could give the Federal Reserve additional cover to ease policy.

Earnings Spotlight

Corporate earnings offered a mixed view of consumer and technology demand. Dollar Tree reported earnings per share of $0.77, ahead of estimates, but issued weaker guidance that pressured its stock. Other notable updates came from Salesforce, Broadcom, Signet, Nio, Zscaler, Campbell Soup, Macy’s, and Lululemon. Results varied by sector, with retailers highlighting cautious consumer trends while technology names showed resilience but faced valuation pressure. Investors parsed commentary carefully for signals on how tariffs, wages, and inflation were impacting margins.

Macroeconomic & Political Backdrop

Politics reemerged as a market driver after President Trump dismissed Federal Reserve Governor Lisa Cook, sparking fresh concerns over central bank independence. While the move rattled confidence in the Fed’s autonomy, U.S. Treasuries outperformed global peers as investors leaned on the perception that tariff revenues would provide near-term fiscal support. Still, analysts cautioned that tariff collections are not a sustainable funding source and that political uncertainty could keep volatility elevated in the weeks ahead.

The Week Ahead (September 8 to September 14, 2025)

With the critical August jobs report now behind us, investor focus turns squarely toward inflation readings, consumer sentiment, and fiscal data that could confirm or challenge expectations for a September rate cut. Market participants will be watching closely to see whether price pressures are easing enough to justify policy easing, or whether sticky inflation and political uncertainty will force the Federal Reserve to remain cautious. Alongside economic releases, earnings updates from technology and retail names will provide fresh signals on corporate resilience heading into the fall.

Consumer Credit Data (Monday, September 8)

The week begins with the Federal Reserve’s report on consumer credit for July, a key measure of household borrowing. Rising credit balances would suggest consumers are leaning on debt to sustain spending amid elevated prices, while a slowdown could point to caution that weighs on retail and discretionary sectors. Markets will parse the data for insight into whether U.S. consumers are still the backbone of growth or beginning to retreat.

NFIB Business Optimism & Trade Reports (Tuesday, September 9)

Small business sentiment for August, tracked by the NFIB, will shed light on hiring plans, pricing power, and investment intentions among Main Street firms. A decline could highlight growing caution around labor costs and tariffs, while an improvement would suggest resilience despite economic uncertainty. In addition, quarterly reports on manufacturing and retail trade will provide a broader look at how producers and merchants are navigating shifting demand and cost pressures.

Producer Price Index (PPI) (Wednesday, September 10)

Wholesale price trends come into focus with the August Producer Price Index report. Economists will look for evidence of easing input costs that could feed through to lower consumer prices in coming months. A hotter than expected PPI would raise concerns that inflationary pressures remain embedded in supply chains, complicating the Fed’s decision making. Conversely, softer wholesale prices would bolster the case for imminent rate relief.

Consumer Price Index (CPI), Jobless Claims, and Federal Budget (Thursday, September 11)

Thursday will be the pivotal day of the week, headlined by the August Consumer Price Index report. Core CPI in particular will guide expectations on whether inflation is continuing to cool. Markets are highly sensitive to even modest surprises, with a stronger print potentially pushing Treasury yields higher and delaying rate cut momentum. The day also brings weekly jobless claims, an important real time gauge of labor market conditions, and the monthly federal budget statement, which will reflect how tariffs and revenue measures are shaping the government’s fiscal stance.

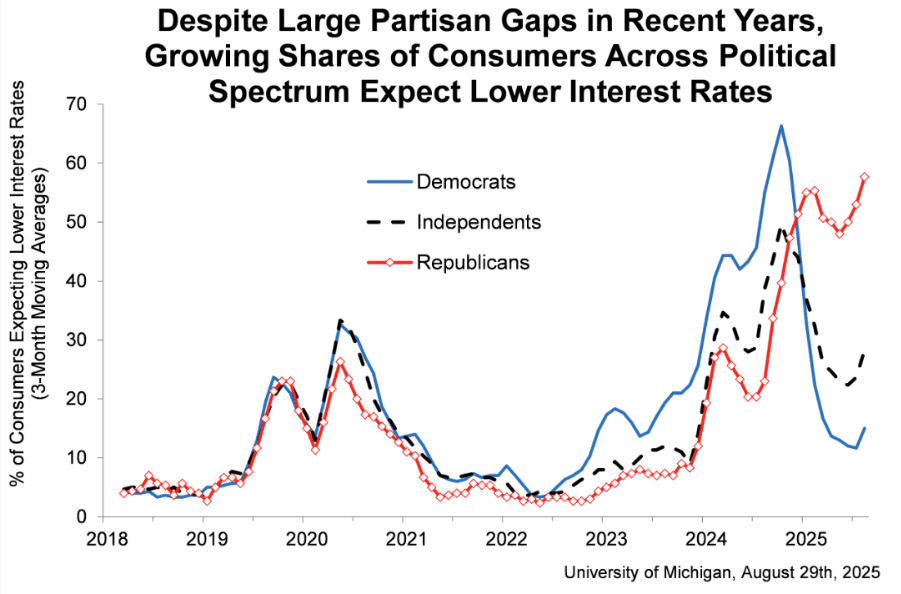

Consumer Sentiment Data (Friday, September 12)

The week closes with preliminary September consumer sentiment data from the University of Michigan. Beyond headline confidence levels, investors will focus on one year inflation expectations embedded in the survey. Rising expectations could undermine the Fed’s credibility in keeping prices anchored, while a decline would reinforce the view that inflation is easing at the household level. With consumer spending still the primary driver of growth, sentiment figures will carry significant weight for equity and bond markets alike.

Earnings to Watch

Alongside macroeconomic data, investors will monitor corporate earnings releases for additional signals on sector-level performance. Technology and AI-linked firms such as Broadcom and Salesforce, which reported in the prior week, will continue to influence sentiment as analysts digest their results and guidance. Retailers and discretionary companies will also remain in focus, with investors parsing commentary for signs of weakening demand or margin pressure as households navigate inflation and higher borrowing costs. Stronger results could stabilize equity markets, while disappointments would reinforce caution heading into fall trading.

Outlook

The first week of September reinforced the view that the U.S. economy is slowing but not stalling, with weaker labor signals, soft manufacturing data, and political shocks around the Federal Reserve keeping investors on edge. Yet equities still managed modest gains as traders leaned heavily on expectations of a September rate cut.

The week ahead will test those assumptions. Inflation readings from the PPI and CPI will be decisive in shaping the Fed’s near-term policy path, while consumer sentiment and jobless claims will provide additional checks on whether households and employers are holding up under pressure. At the same time, earnings updates in technology and retail will add a corporate lens to the macro story, highlighting how firms are navigating tariffs, costs, and shifting demand.

Markets remain highly sensitive, with even modest surprises capable of moving yields, equities, and currencies in sharp fashion. Whether optimism about rate relief continues to underpin stocks or gives way to renewed volatility will depend on how this week’s data align with investors’ high expectations for Fed easing.