The Week That Was & The Week Ahead: August 4, 2025

Calisade Capital is an asset management firm that delivers institutional advisory services and weekly insights to the retail market via its Calisade Digests. Calisade focuses on creating alpha through robust macro, fundamental, technical, and sentiment research.

The Week That Was (July 28 to August 1, 2025)

The week brought a stronger-than-expected GDP rebound and upbeat tech earnings, offering a lift to equities. However, elevated inflation, dissent within the Federal Reserve, and sweeping new U.S. tariffs added layers of uncertainty, keeping investor sentiment cautious and reactive.

A Much‑Stronger‑Than‑Expected GDP Rebound

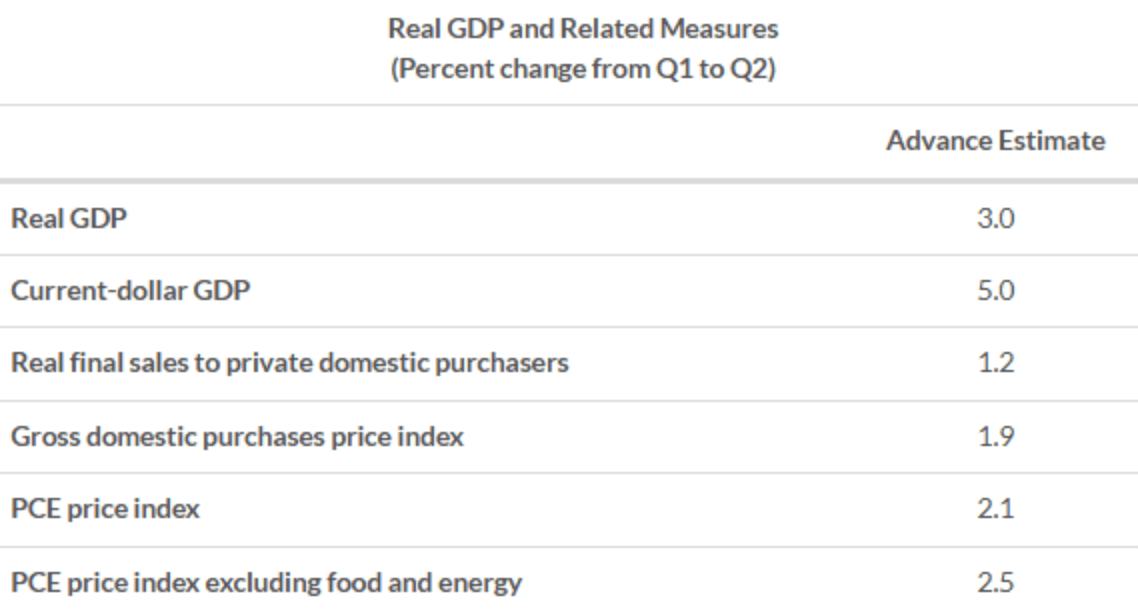

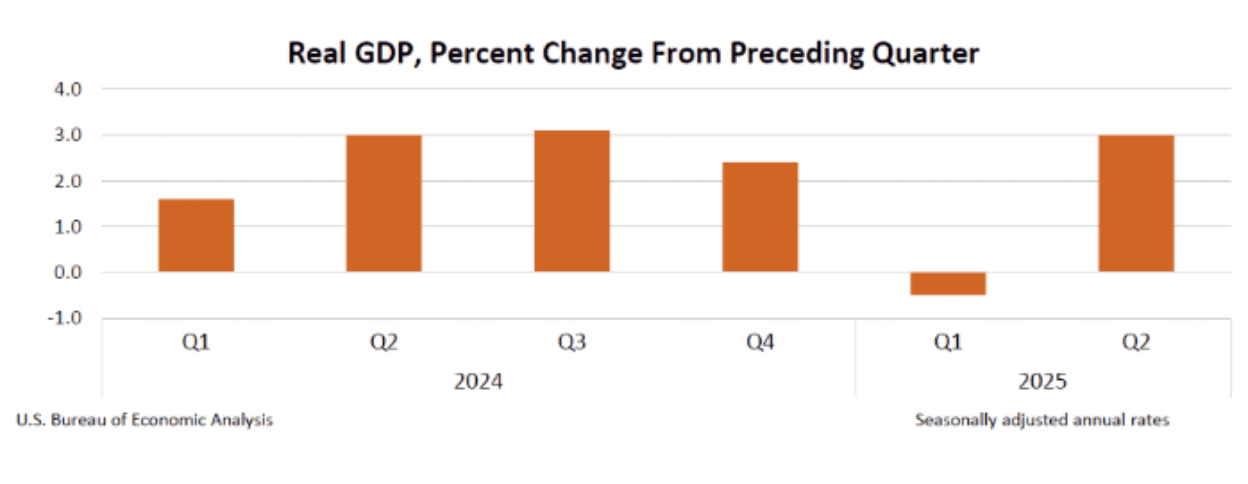

The U.S. economy bounced back in Q2, growing at an annualized 3.0%, reversing the contraction earlier in the year. Yet beneath the headline beat, demand looked softer than it first appeared, final sales to domestic purchasers rose just 1.2%, highlighting that the rebound relied more on trade swings than robust internal growth.

Fed Holds Steady Amid Inflation Signals

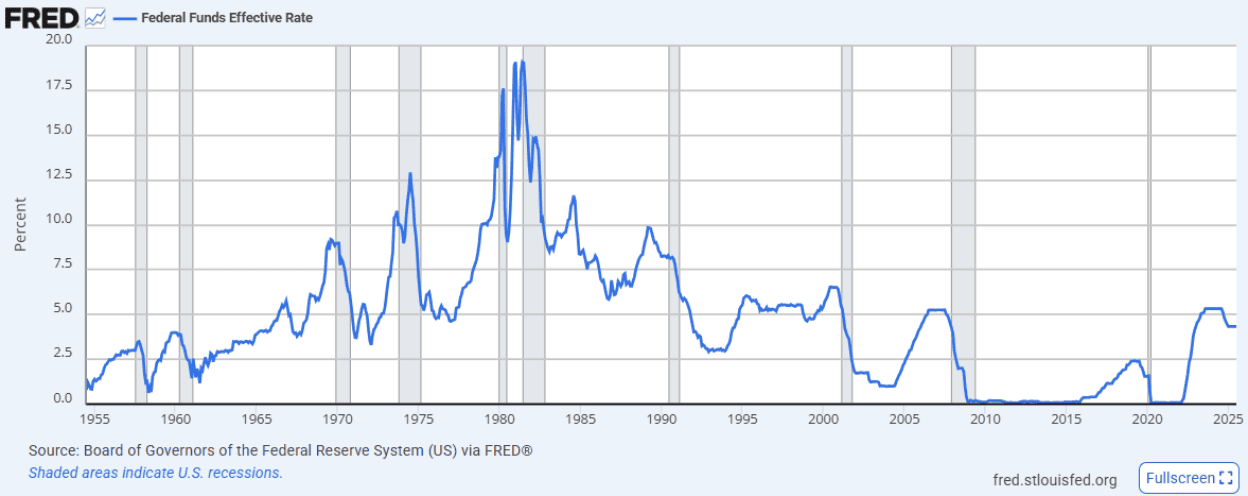

As expected, the Federal Reserve held its benchmark rates at 4.25–4.50% at its July 30 meeting. The decision passed with a 9‑to‑2 vote, though notably two members appointed by the previous administration dissented in favor of a rate cut. Chair Powell’s tone reflected caution, citing persistent inflation risks and trade uncertainty.

Economic News Release: Labor Market Surprises on the Softer Side

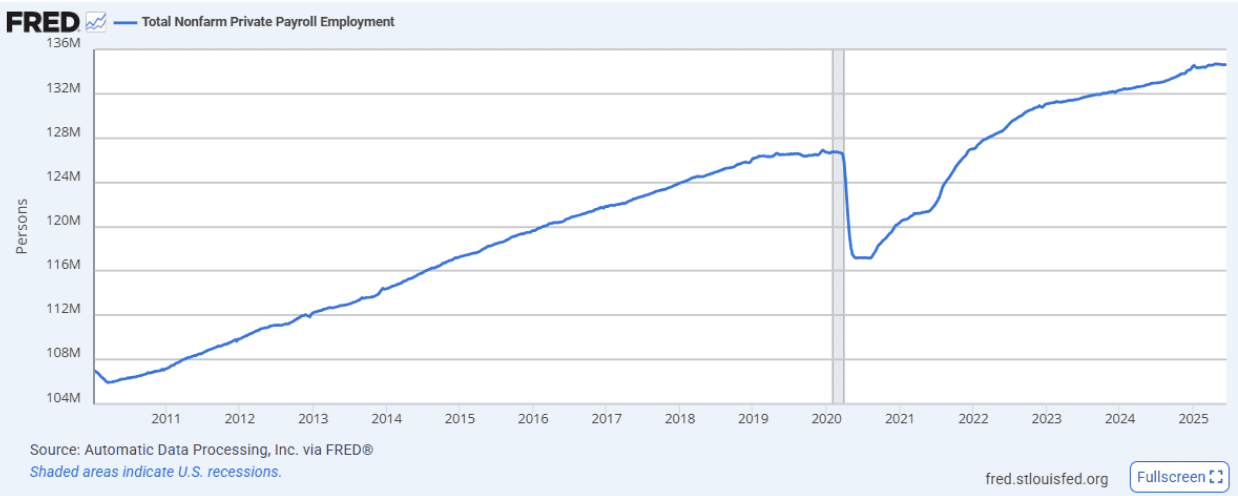

The July jobs report landed softer than expected, catching markets a bit off guard. Total nonfarm payrolls rose by just 73,000, well below the anticipated range of 102,000 to 115,000 jobs. This marks the third straight month of subdued hiring, reinforcing the idea that the labor market is losing some momentum.

The unemployment rate held steady at 4.2%, in line with expectations, suggesting no major deterioration but also little improvement. While the job market remains resilient, the low hiring figures signal that employers are treading carefully amid persistent economic uncertainty and rising labor costs.

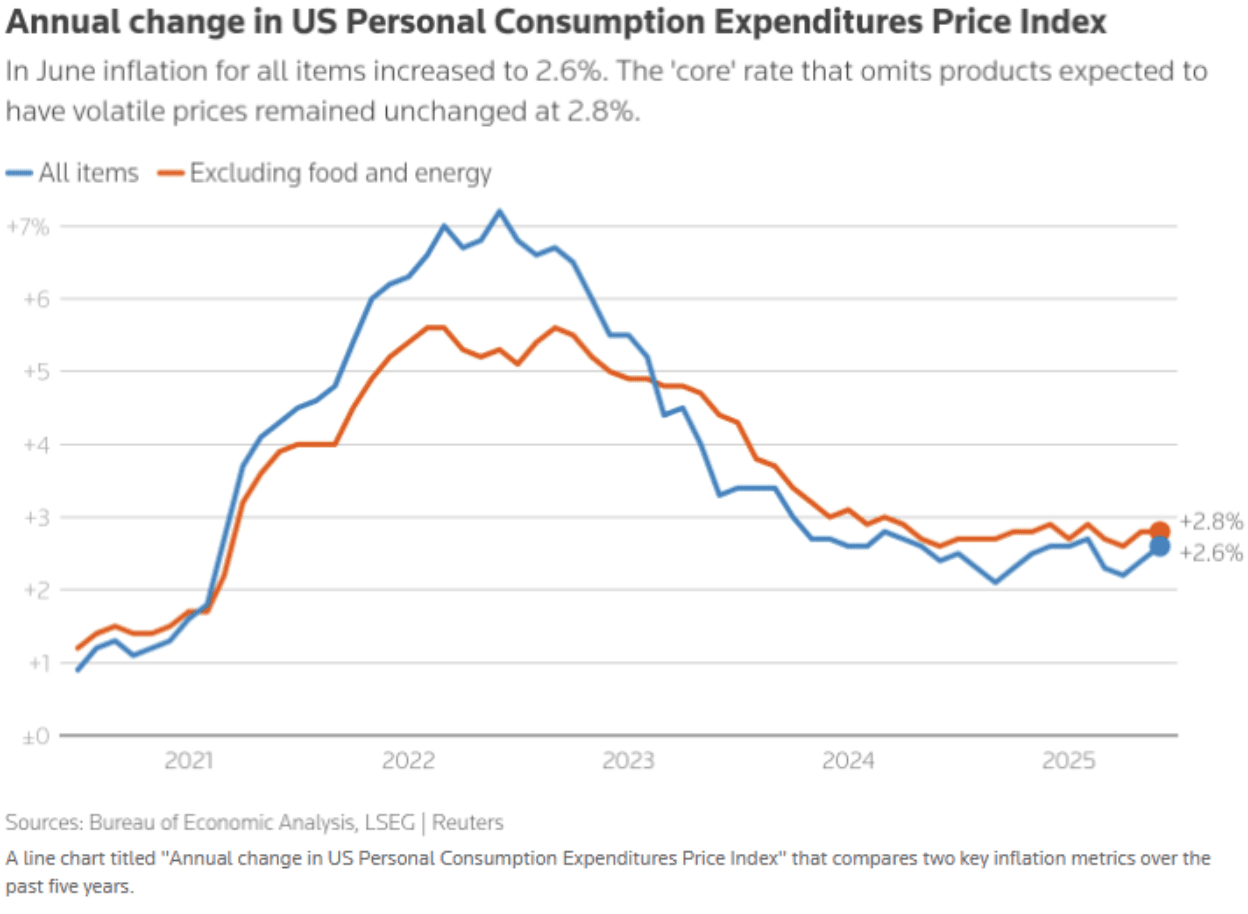

Inflation Spikes Again

June’s Personal Consumption Expenditures (PCE) rose 0.3% month‑on‑month, while core PCE (excluding food and energy) climbed at a 2.8% annual rate, its strongest rise in months. Tariff‑driven price spikes in goods like furniture and apparel added to upward pressure, making inflation look stickier than hoped.

AI Earnings Continue to Shine

Mega‑cap results powered sentiment. Microsoft reported a 39% surge in Azure revenue, beating expectations, and announced it plans to spend a record $30 billion this quarter on AI‑related infrastructure. The company briefly touched a $4 trillion market valuation, only the second public company ever to do so. Meta also beat forecasts and raised guidance, helping lift futures to new highs.

Tariffs Shook Global Markets

President Trump signed an executive order imposing reciprocal tariffs ranging from 10% to 41% on imports from over 90 countries. Key targets included Canada (35%), India (25%), and Taiwan (20%). This triggered immediate volatility. Equities, currencies and commodities all wobbled as markets reassessed trade risks. Futures for major indexes fell sharply following the announcement; the dollar strengthened amid the risk‑off shift.

While markets ended the week with modest gains, led by tech, the underlying tone was fragile. Tariff uncertainty, sticky inflation, and softer domestic demand pressed.

The Week Ahead (August 4 to August 8, 2025)

The week ahead will center on key indicators including labor costs, jobless claims, and productivity data, while corporate earnings and ongoing trade developments add to the mix. Together, these signals will influence market direction and sentiment for the weeks ahead.

Labour Market & Productivity Check‑in

With July payroll data now behind us, upcoming releases on initial jobless claims, productivity, and unit labor costs will help gauge underlying labor market pressures. These will signal whether wage growth is decelerating, and inflation may ease further.

Earnings Momentum Carries On

Corporate reporting continues into the coming week, this time featuring energy, finance, retail, and consumer discretionary names. Investors will hone in on forward guidance especially commentary on tariff exposure, wage inflation, and margins.

Trade developments remain the wild card

As new tariff cuts or deals snap into place or stall markets will respond quickly. Whether further concessions emerge with Canada, EU or China will be critical. Geopolitical signals and regulatory developments may also spur further volatility.