Calisade outperforms S&P and NASDAQ benchmarks again in February; flat over the last 12 months

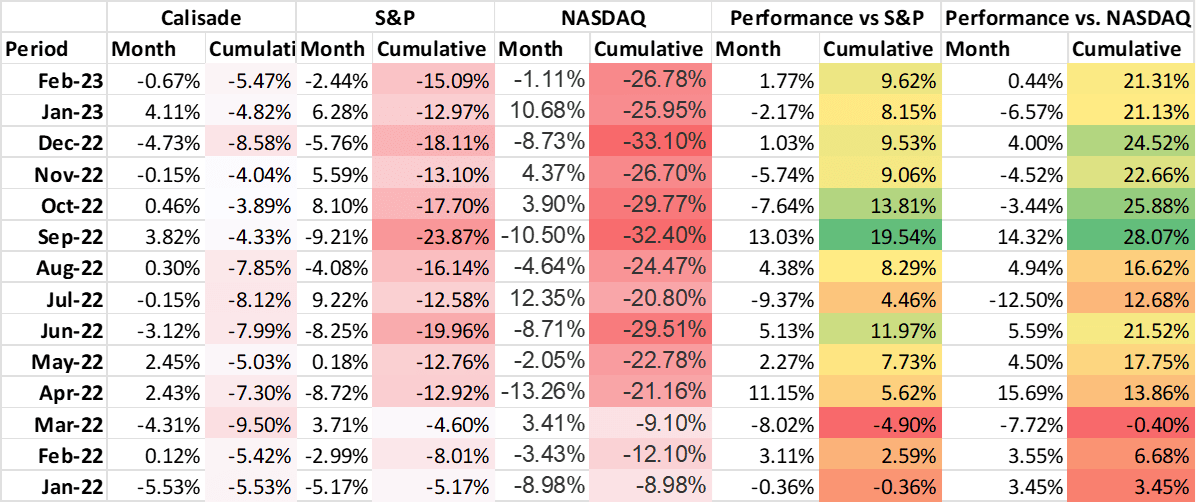

In February, the Calisade flagship fund was down -0.67%, versus the S&P being -2.44% and the NASDAQ being -1.11%.

Since inception, the fund is down -5.47% vs. -15.09% for the S&P and -26.78% for the NASDAQ.

Over the trailing 12 months, the fund is down -0.05% vs. -7.69% on the S&P and -16.7% for the NASDAQ.

Our outperformance to date has been largely due to our thematic bets long on energy and short on unprofitable technology, as well as single stock selection driven by our proprietary research. We took a bit of time fully transitioning technology positions out of our portfolio in 1Q23, but since 2Q23 have gained ~4% while the S&P is down ~11% and the NASDAQ is down ~17%.

While immediate-term stock moves are heavily influenced by the day's market news and technical factors, we believe that earnings revisions combined with further Fed rate hikes to combat persistent inflation will push equities down further over the near term.

The short term bull case is that technical support technical support exists at these levels. In fact, the S&P did bounce off of 50-day moving average levels today. Moreover, equity prices seem affordable relative to pre-crash levels, enticing some dip buyers. These can feed on each other in the sorts of bear market rallies we saw last year starting in March, June, and October, and again in January 2023. In fairness, too, we believe that the longer term prospects for domestic equities are decent, and that buy-and-hold investors getting into the market today will see reasonable gains in 2-3 years. However, we expect the fundamentals will win out in the immediate term, as earnings decline and the willingness to take equity risk is combatted by the newly attractive yields for short term treasuries. Whereas we lived in a "There Is No Alternative" (TINA) market for the last several years, we most decidedly live in a "There Is An Alternative" (TIAA) market presently, with 2-year yields over 5%. We believe there's still more capital to be pulled from equities and placed in fixed income.

We presently advocate for investment in:

VERY short duration bonds - Short term rates are going up. Higher yields mean lower prices in the secondary market. But if you hold to term, locking in current yields for a few weeks or a few months is a great strategy.

Stocks with strong fundamentals that have been discounted too far - Some babies have been thrown out with the bathwater. Certain value plays are out there.

With respect to shorting:

Our short positions are quite small given the conflicting signals from technicals vs. fundamentals. If resistance at the 50 and 200 day moving averages doesn't hold, then a bigger short position would be warranted. To wit, we just saw a significant bounce off the S&P's 50-day level today. At present, only stocks with exceedingly high valuations and unclear paths to profitability warrant short consideration. The risk-reward of short investments given the current technical setup is tenuous though. Further, the number of these grossly overvalued stocks has been widdled down significantly over the last year..