Weekly Market Wrap

Calisade Capital is an asset management firm that delivers institutional advisory services and weekly insights to the retail market via its Calisade Digests. Calisade focuses on creating alpha through robust macro, fundamental, technical, and sentiment research.

After a short pause last week, we return with our regular Monday market outlook. These weekly notes are designed to give investors a clear picture of what shaped markets in the prior week and what to expect in the days ahead. The U.S. economy is showing signs of transition, with inflation data, retail earnings, and central bank commentary pulling investor sentiment in different directions. The past week offered valuable signals about growth momentum and policy, while the upcoming week brings a heavy mix of earnings, economic releases, and Fed guidance that could set the tone for September.

The Weeks that Were (August 11–24, 2025)

The two weeks spanning August 11 to August 24 offered contrasting tones, with the first week marked by positioning ahead of critical inflation releases and the second dominated by retail earnings and early signals from Jackson Hole. In the week of August 11 to August 17, markets traded cautiously as July CPI and PPI data shaped expectations for monetary policy, with investors weighing softer consumer inflation against a sharp producer-price surprise. By contrast, the week of August 18 to August 24 carried muted optimism, as resilient retail sales and dovish hints from Powell helped offset concerns around tariffs and slowing leading indicators. Across the fortnight, sentiment was defined by the tug-of-war between softening macro data, consumer resilience, and persistent geopolitical risks that continue to anchor investor psychology.

Equity Market Performance

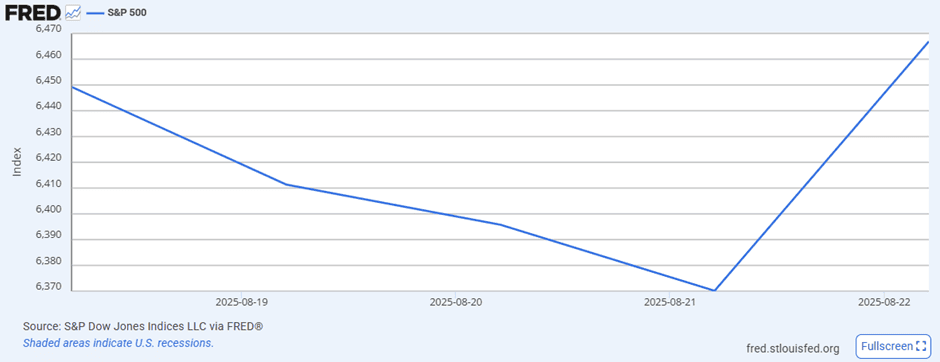

Equities reflected alternating crosscurrents across the two weeks. From August 11 to August 15, both the S&P 500 and NASDAQ edged higher in the early part of the week, supported by softer-than-feared CPI data, before fading into the weekend as a sharp rise in producer prices and weaker consumer sentiment weighed on confidence. The S&P 500 climbed from 6,370 on August 11 to a midweek high of 6,465 on August 14, while the NASDAQ peaked near 6,450 before easing slightly.

The following week of August 18 to August 22 began on a cautious note as investors digested retail earnings from Walmart, Home Depot, and Target, but momentum shifted after Powell’s tone in Jackson Hole was interpreted as dovish by markets. Both indices sold off into August 21, with the S&P 500 hitting 6,370 and the NASDAQ slipping to 6,360, before staging a sharp rebound on August 22. The S&P 500 finished at 6,467 and the NASDAQ at 6,450, leaving both benchmarks modestly higher over the two-week stretch.

Retail Sales Trends

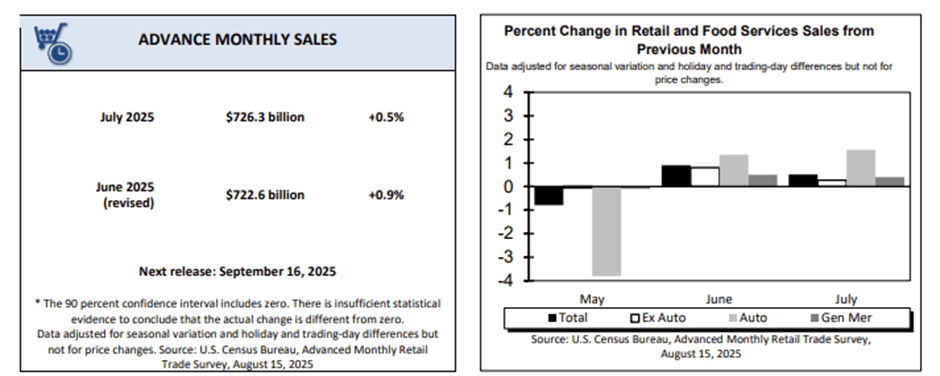

The Commerce Department’s Census Bureau reported on August 15, 2025, that July retail sales rose 0.5% from the previous month, driven by strong auto sales and promotional events. Core retail sales, which exclude autos, gasoline, and building materials, also increased 0.5%. Much of this strength was linked to Amazon Prime Day and early back-to-school shopping, highlighting the role of seasonal promotions in supporting consumer spending.

Consumer Sentiment

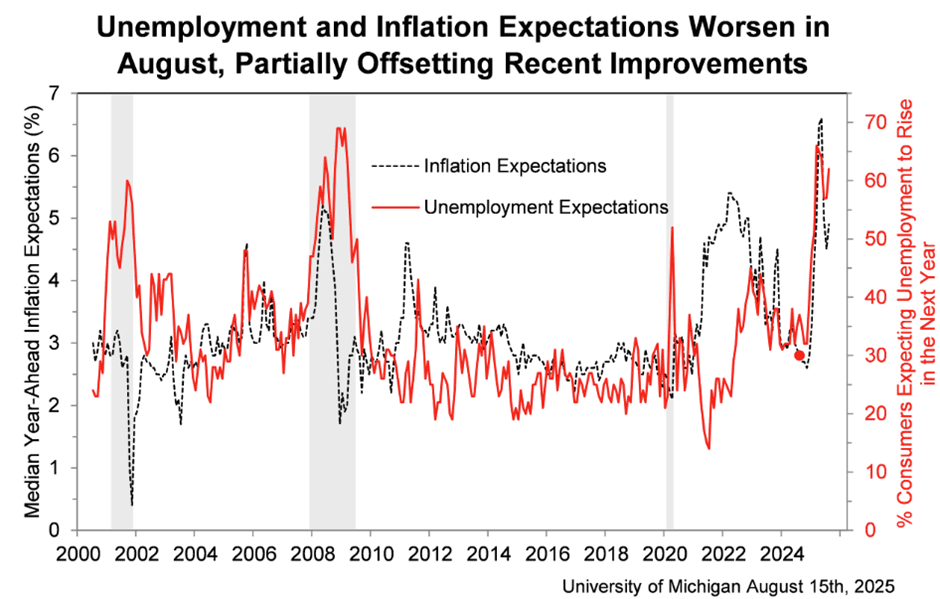

Consumer sentiment weakened in August as the University of Michigan’s preliminary index, released on August 15, 2025, fell 5% to 58.6 compared with 61.7 in July. The decline reflected growing concerns among households about tariffs, rising living expenses, and the broader economic outlook. The drop in confidence suggested that while consumer spending remained steady, underlying worries about inflation and trade tensions were starting to weigh more heavily on sentiment.

Consumer and Inflation Dynamics

The July inflation data painted a mixed picture. Headline CPI, released on August 12, 2025, rose 0.2% month on month and 2.7% year on year, broadly in line with expectations. Core CPI, which excludes food and energy, firmed to 3.1%, signaling persistent underlying pressures. A sharper surprise came from the Producer Price Index, released on August 14, which jumped 0.9% in July, the steepest increase since mid-2022. Much of the rise was attributed to tariff-driven cost pressures, raising the risk that higher producer expenses could spill over into consumer prices in the months ahead.

Inflation & Leading Indicators

The Conference Board’s Leading Economic Index, released on August 21, declined 0.1% in July to 98.7, marking a six-month cumulative drop of 2.7%. The sustained decline reinforced concerns that forward-looking momentum in the U.S. economy continues to fade. In contrast, the Coincident Economic Index ticked higher, indicating that current activity remains resilient but is beginning to lose pace. Taken together, the data suggest that while growth is not collapsing, structural fragilities are becoming more visible.

Corporate & Geopolitical Highlights

Corporate headlines injected pockets of optimism into an otherwise cautious week. Novo Nordisk shares advanced after the FDA approved Wegovy for treating MASH, a milestone that boosted sentiment in the biotech sector. Dayforce also stood out, rallying more than 25% on speculation of a potential takeover, underscoring the market’s appetite for deal-driven catalysts. On the geopolitical front, the U.S. hosted a European-White House summit on August 18 focused on Ukraine, a reminder that persistent geopolitical tensions continue to weigh on global stability and commodity markets.

The Week Ahead (August 25–31, 2025)

The upcoming week is expected to be pivotal, with investors watching both economic releases and corporate earnings against the backdrop of dovish Federal Reserve signals. With the Jackson Hole symposium behind us, the focus now shifts to whether incoming data and earnings results will support the growing market consensus that a rate cut is on the horizon. This week could define whether optimism carries into September or falters under new uncertainties.

Fed Outlook and Market Positioning

Federal Reserve Chair Jerome Powell’s remarks at Jackson Hole hinted at a possible rate cut in September, citing a cooling labor market and easing inflationary pressures. Markets quickly repriced expectations, with rate cut odds climbing above 85%. The key question now is whether upcoming macro data aligns with this narrative, or if surprises could force the Fed to delay action.

Corporate Earnings in Focus

On the corporate front, technology earnings will dominate headlines. Nvidia is set to report results midweek, followed by CrowdStrike, Snowflake, and HP Inc. In the retail space, Best Buy, Kohl’s, and Gap are also scheduled to release earnings. With technology stocks leading market momentum in 2025, Nvidia’s report in particular could act as a bellwether for broader investor sentiment.

Early Week Indicators

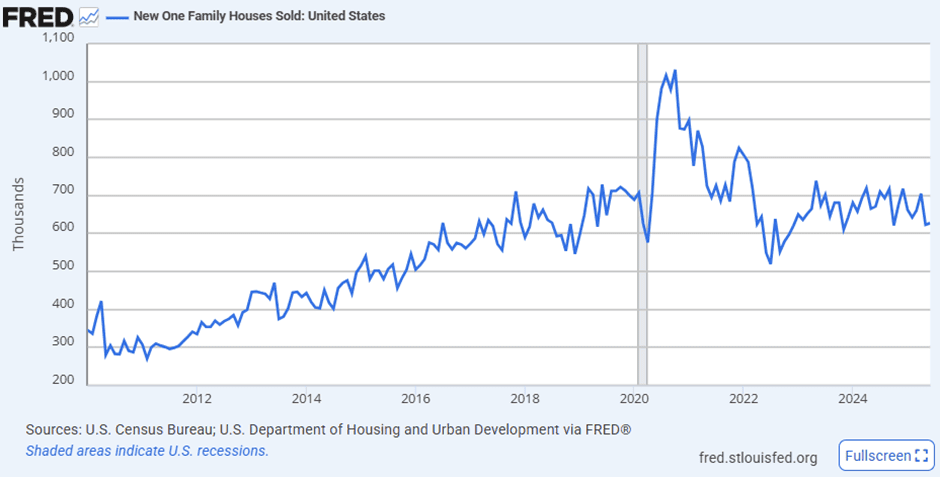

The economic week begins on August 25, 2025, with new home sales, offering insight into housing demand. On August 26, durable goods orders, the Case-Shiller home price index, and consumer confidence are released. Together, these early reports provide a snapshot of consumer activity, housing strength, and business investment momentum as investors gauge the economy’s resilience.

Midweek Data and Policy Signals

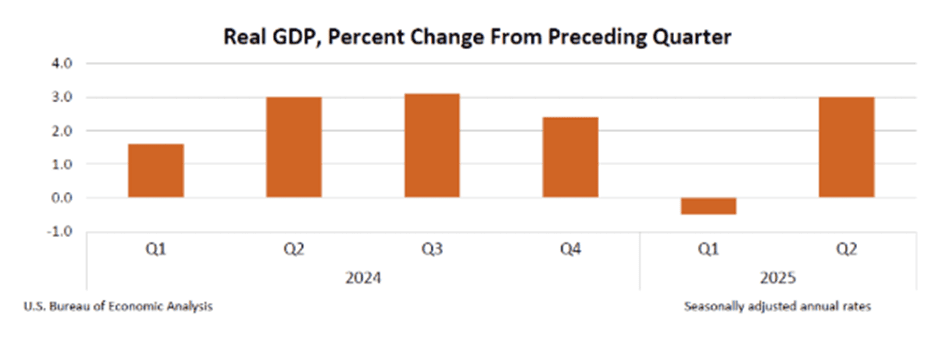

Thursday brings several critical releases. The second estimate of Q2 GDP will update growth momentum, while weekly jobless claims highlight labor market conditions.

Pending home sales offer another look at housing. Fed Governor Christopher Waller’s scheduled speech could provide fresh policy signals, making Thursday a key inflection point for both economic data and monetary guidance.

Closing Data Releases

The week concludes with July’s PCE inflation report, the Federal Reserve’s preferred price gauge, which will be closely watched for policy implications. Additional data on trade balance and wholesale inventories provide context for supply chain dynamics. The revised University of Michigan sentiment survey rounds out the week, reflecting household views on inflation, tariffs, and overall economic conditions.

Global and Geopolitical Risks

Beyond U.S. domestic data, trade and geopolitical risks continue to simmer. Tensions between the U.S. and India remain unresolved, with a looming August 27 deadline for potential tariff escalation that could see Indian duties rise to 50%. Meanwhile, commodity markets are likely to respond to shifts in inflation expectations, with gold positioned as a hedge if data surprises to the upside.

Outlook

The past week reflected the crosscurrents investors must navigate: slowing leading indicators, sticky inflation at the wholesale level, and persistent geopolitical risks. Yet optimism lingered in selective corporate stories and in the Fed’s more dovish tone.

The week ahead has the potential to be a turning point. If the PCE report confirms moderating inflation and GDP growth remains solid, the path to a September rate cut will look clearer, supporting equity markets. At the same time, Nvidia’s earnings could provide the spark needed to reinforce confidence in tech leadership. However, tariff risks and any upside inflation surprises could quickly disrupt this fragile balance.