The Fed Is Stuck Between a Rock and a Hard Place, as Economic Signals Call for a Cut as Elevated Inflation Remains

Calisade Capital is an asset management firm that delivers institutional advisory services and weekly insights to the retail market via its Calisade Digests. Calisade focuses on creating alpha through robust macro, fundamental, technical, and sentiment research.

Mid-September unfolded with investors weighing persistent inflation signals, fragile labor market data, and renewed political scrutiny of the Federal Reserve. The week brought a mix of hotter-than-expected consumer prices, rising jobless claims, and cautious consumer sentiment, all of which reinforced expectations that the Fed remains under pressure to deliver policy easing at its upcoming meeting.

Equity markets managed modest gains despite the uneven backdrop, supported by hopes that rate relief is near. Yet, as the dust settled, attention quickly turned to the week ahead, where the Fed’s policy decision, fresh retail sales data, and import-export price reports will determine whether markets can sustain their resilience or face another bout of volatility.

The Week That Was (September 8 to September 14, 2025)

The second week of September was marked by a tug-of-war between hopes for monetary easing and the reality of sticky inflation. Investors digested a steady stream of economic signals that painted a mixed picture: consumer prices ran hotter than expected, jobless claims jumped to their highest level in nearly four years, and corporate earnings underscored widening divides between resilient technology firms and pressured retailers.

Markets held their footing, with equities edging higher and Treasuries rallying as traders bet the Federal Reserve will have little choice but to ease policy at its upcoming meeting. Yet the underlying tone was cautious, reflecting the challenge of navigating a slowing labor market alongside stubborn price pressures.

Market Sentiment & Tone

Investors entered the second week of September with mounting conviction that the Fed will cut rates at its upcoming meeting. Cooling labor data paired with an uptick in inflation reinforced the view that monetary policy must balance supporting growth with containing price pressures. Equities posted gains early in the week, particularly in interest-rate sensitive sectors, before paring back as inflation data surprised slightly to the upside.

The S&P 500 ended the week up 1.32%, while the Nasdaq outperformed with a gain of 1.39%, buoyed by technology resilience. U.S. Treasuries rallied, with the 10-year yield slipping to about 4.06% on expectations of near-term easing.

Inflation Data (CPI & PPI)

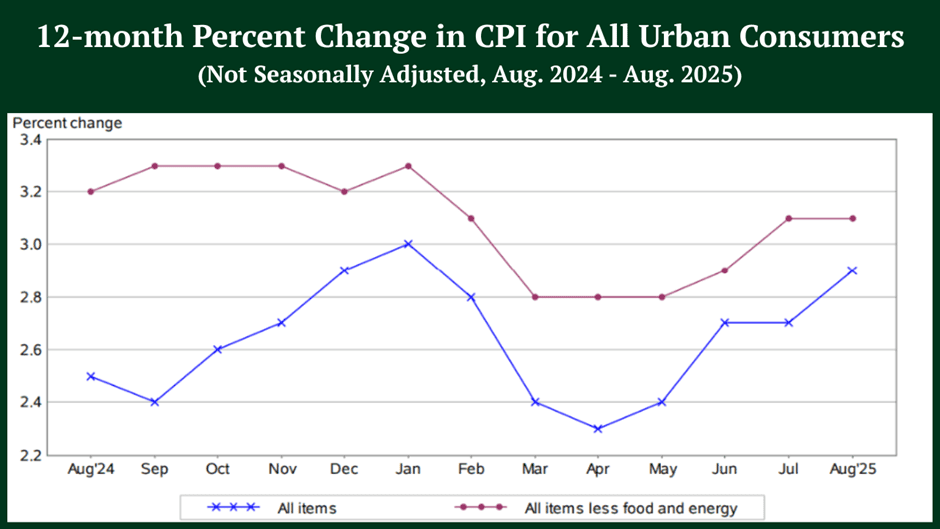

U.S. inflation data released during the week of September 8-14, 2025, highlighted the persistent challenge facing the Federal Reserve. The Consumer Price Index (CPI) rose 2.9% year-over-year in August, up from 2.7% in July, while core CPI held steady at 3.1%, reflecting sticky underlying price pressures. On a monthly basis, headline CPI increased by 0.4%, with core CPI climbing by 0.3%, underscoring that inflation remains entrenched despite signs of slowing growth.

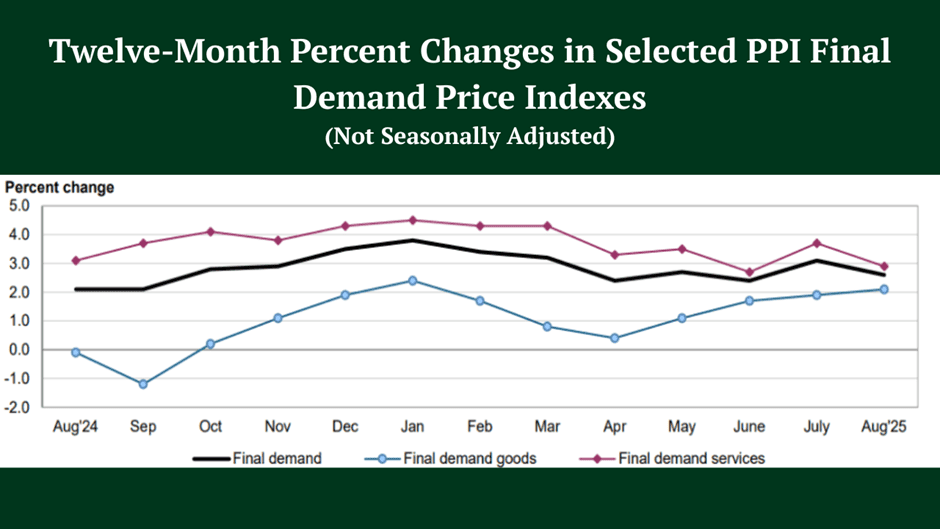

Producer prices also pointed to ongoing cost pressures across supply chains, with the Producer Price Index (PPI) for final demand slipping by 0.1% month-over-month but still rising 2.6% over the past year. The more closely watched core PPI, which strips out food, energy, and trade services, advanced by 2.8% year-over-year, reinforcing concerns that inflationary dynamics remain embedded at the wholesale level.

Labor Market Signals

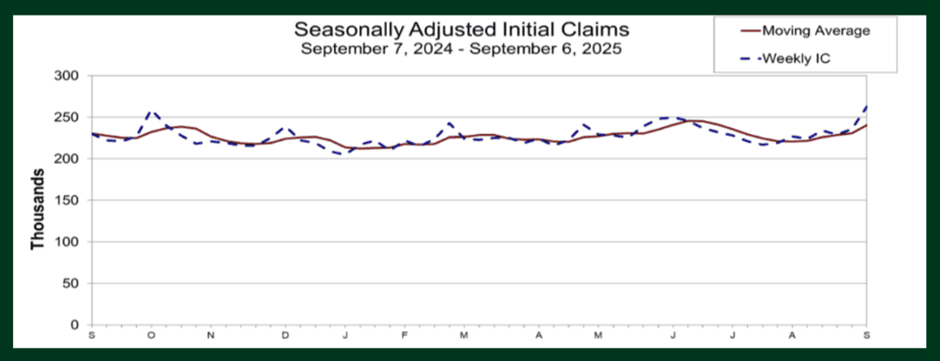

Labor market developments during the week underscored clear signs of cooling, putting pressure on the Fed’s timeline for rate cuts. On September 11, 2025, the Labor Department reported that initial weekly jobless claims surged to 263,000 for the week ending September 6, 2025, up by 27,000 from the prior week and marking the highest level since October 2021.

Earlier, on September 5, 2025, the August nonfarm payroll report revealed that U.S. employers added just 22,000 jobs, a dramatic slowdown from expectations, while the unemployment rate rose to 4.3% from 4.2% in July. Together with downward revisions to earlier months, these figures suggest a labor market under strain that is losing momentum.

Retail Sales & Consumer Data

Retail sales and consumer sentiment data will be closely watched for signs of household resilience. Consumer spending remains the backbone of U.S. growth. Any softening would add urgency to Fed support, while stronger than expected figures could temper rate cut enthusiasm.

The University of Michigan is scheduled to release the preliminary September 2025 consumer sentiment data on September 12, 2025, at 10:00 a.m. Eastern Time. This survey measures consumer attitudes toward economic conditions, personal finances, and inflation expectations, providing valuable insights into household confidence and spending behavior. A decline in sentiment could signal concerns about economic prospects, potentially influencing the Federal Reserve's policy decisions.

Corporate Earnings Spotlight

Earnings reports during the week reinforced a tale of two extremes in corporate America: retailers are flagging caution as consumers pull back under inflation and rising borrowing costs, while many technology firms show resilience even as valuation pressures mount.

For example, Lululemon slumped almost 19% after lowering its full-year outlook, citing weak U.S. demand and the impact of trade tariffs that could cost the company up to $320 million by 2026. At the same time, Oracle’s earnings surprised many with strong AI-cloud infrastructure demand helping to offset margin pressures from rising costs, pushing investor enthusiasm even as some parts of its business face compression.

Retail sentiment more broadly is under strain. Sectors like staples and discretionary lag S&P 500 earnings growth, weighed by tariff impacts and rising input costs, as consumers grow more price sensitive. Technology, meanwhile, benefits from structural tailwinds in AI, cloud spending, and strong large-cap earnings, but investors are scrutinizing forward guidance, cost controls, and input cost inflation closely.

Political & Macro Backdrop

Political developments again influenced sentiment. Renewed debates over fiscal sustainability and tariff reliance left investors wary of prolonged volatility. At the same time, U.S. Treasuries outperformed global peers: the 10-year U.S. Treasury yield fell about 15 basis points last week to 4.08%, while many international sovereign bond yields were flat or rising.

The Week Ahead (September 15 to September 21, 2025)

The week ahead is set to be pivotal as markets shift focus to the Federal Reserve’s September 17 policy decision. While a 25 basis point cut is widely expected, the tone of Chair Powell’s remarks and updated projections will guide sentiment on future easing. Alongside the Fed, key releases including import and export price indexes, state employment data, and retail sales will test household resilience and global cost pressures, shaping whether recent market optimism can hold or fade.

Import & Export Price Indexes (Tuesday, September 16)

Trade-related inflation data will provide further insight into whether global cost pressures are easing. Rising import prices could complicate the Fed’s inflation fight, while easing trends would reinforce the case for policy easing. The Bureau of Labor Statistics (BLS) is scheduled to release the August 2025 U.S. Import and Export Price Indexes on September 16, 2025, at 8:30 a.m. Eastern Time.

These indexes measure the average change over time in the prices of goods and services traded internationally, serving as crucial indicators of inflationary pressures from abroad. A significant increase in import prices could signal rising costs for U.S. consumers and businesses, potentially influencing the Federal Reserve's monetary policy decisions.

Federal Reserve Policy Decision (Wednesday, September 17)

The pivotal event of the week is the Federal Reserve's policy decision on September 17, 2025. While markets have priced in a rate cut, the size of the move and the tone of Chair Powell’s statement will be decisive for risk assets. Investors will focus on updated economic projections and the “dot plot” to gauge the Fed’s forward-looking stance.

The Federal Reserve Board has confirmed that the next Federal Open Market Committee (FOMC) meeting is scheduled for September 16-17, 2025, with a press conference to follow. This meeting will be closely watched for indications of the Fed's approach to managing inflation and supporting economic growth amid evolving labor market conditions.

State Employment Data (Thursday, September 19)

Regional labor market figures will provide another test of whether job weakness is broadening across the U.S. economy. Evidence of sustained layoffs could reinforce the case for additional easing later in 2025.

The Bureau of Labor Statistics (BLS) is scheduled to release the State Employment and Unemployment data for August 2025 on September 19, 2025, at 10:00 a.m. Eastern Time. This data will offer insights into employment trends at the state level, highlighting areas of strength or concern within regional labor markets. A continued rise in unemployment rates or significant job losses in key sectors could prompt policymakers to consider further monetary stimulus to support economic stability.