Weekly Market Wrap

Calisade Capital is an asset management firm that delivers institutional advisory services and weekly insights to the retail market via its Calisade Digests. Calisade focuses on creating alpha through robust macro, fundamental, technical, and sentiment research.

After a data-heavy close to August, we return with our regular Monday market outlook. These notes are designed to provide investors with a clear snapshot of what shaped markets in the past week and what lies ahead. The final week of August brought stronger growth signals, dovish central bank commentary, and closely watched inflation data, while political interventions and trade tensions added complexity. As we step into September, the focus turns to jobs data, Fed expectations, and whether easing momentum will sustain market optimism.

The Week That Was (August 25–29, 2025)

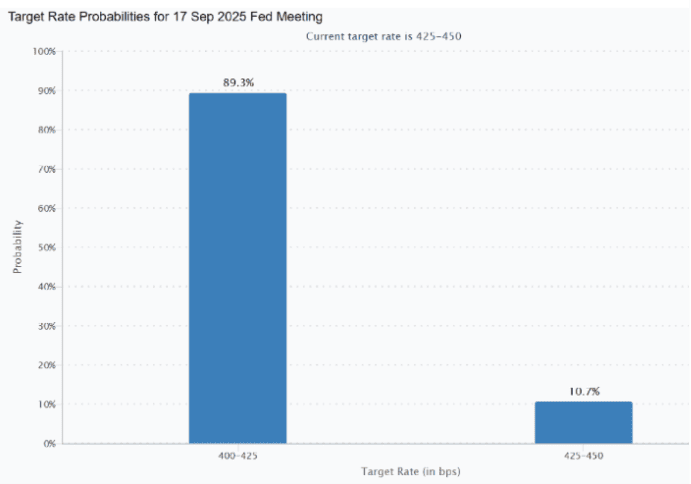

At the Jackson Hole Economic Symposium, Fed Chair Jerome Powell struck a dovish tone, cautioning that downside risks to employment are rising and indicating that the balance of risks may warrant adjusting policy, fueling speculation of a September rate cut (CME Fed Watch odds rising to 85%, up from 73% before his speech). The market reaction was swift and meaningful via Friday’s rally: the S&P 500 surged approximately 1.52% for its strongest single-day gain since late May, while the Dow Jones Industrial Average gained 1.89% and the Nasdaq climbed 1.88%. Bonds rallied too, as yields fell 10 basis points on the 2-year note and 7.4 basis points on the 10-year Treasury.

Equity Market Performance

Growth and Inflation Signals

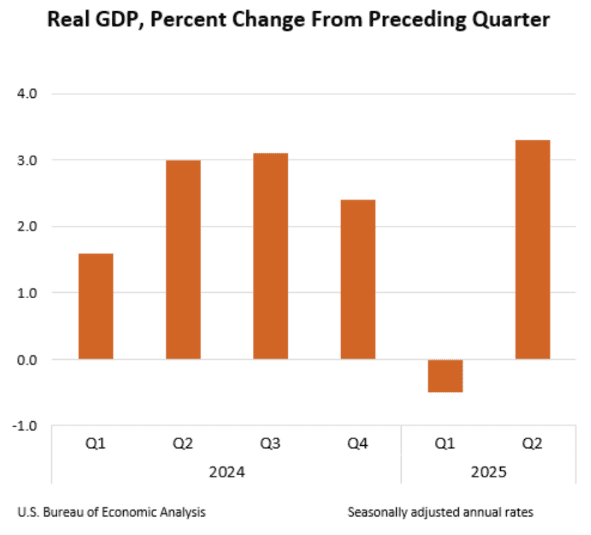

Q2 GDP Revision: The U.S. economy’s growth in Q2 2025 was revised upward to 3.3% annualized, up from the initial 3.0%, a notable rebound from the –0.5% contraction in Q1. This revision reflected stronger consumer spending and investment, aided by a sharp drop in imports that boosted GDP figures.

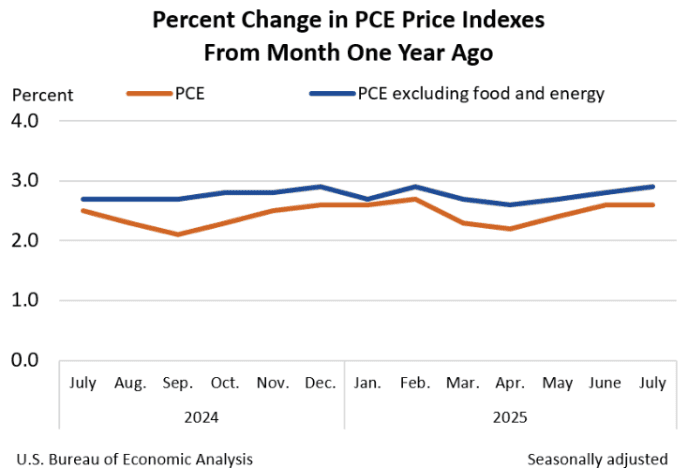

PCE Inflation Data (July): The PCE price index rose 2.6% year-over-year in July, unchanged from June, while core PCE inflation (excluding food and energy) increased 2.9%, up from 2.8% in June and the highest since February. On a monthly basis, headline PCE advanced 0.2%, a slight slowdown from June’s 0.3% rise, while core PCE rose 0.3%, matching the prior month. These figures, released by the Bureau of Economic Analysis on August 29, highlight persistent underlying inflation pressures even as headline inflation holds steady.

Corporate Highlights

Nvidia Earnings: The chipmaker delivered a strong quarter, with quarterly revenue surging 56%, yet its shares slipped amid uncertainty over its China outlook and data-center demand. Investor caution also stemmed from questions around export controls, particularly regarding the H20 chip leading to a tepid market response despite the solid topline growth.

Intel Government Stake: In a historically rare move, the U.S. government acquired a 9.9% stake in Intel for approximately $8.9 billion, using CHIPS Act grants converted into equity. This deal sparked concern over its potential to harm Intel’s international business and impede future grant access. Intel’s CFO confirmed that $5.7 billion in cash has already been received, further solidifying the transaction’s impact on the company’s strategic outlook.

Political and Geopolitical Risks

Markets had to digest a series of unsettling political headlines. The firing of Fed Governor Lisa Cook reignited concerns over institutional independence. Meanwhile, the tariff escalation with India, doubling duties on Indian imports to 50% drew sharp criticism from economists and underscored the fragility of global trade ties.

The Week Ahead (September 1 – 7, 2025)

With the Jackson Hole signals now behind us, the first week of September is poised to be pivotal. Markets will turn to labor data, productivity figures, and policy expectations to determine if momentum can carry into the new month.

Key Economic Releases

Jobs Report (Friday, Sept 5)

The non-farm payrolls release will be the focal point of the week, with markets assessing whether job growth is cooling. Beyond headline payroll numbers, revisions, unemployment, and wage growth will matter. A soft report would support September rate cut expectations, while strength could challenge the Fed’s dovish signals (Reuters).

Job Openings and Labor Turnover Survey (JOLTS) Report (Sept 3)

The JOLTS will give an early read on labor demand before payrolls. Declining openings would indicate easing wage pressures, while the quits rate remains a key gauge of worker confidence. Policymakers increasingly treat JOLTS as a forward-looking barometer for tightness in the labor market.

Productivity & Costs (Sept 4)

The productivity and unit labor cost report will be closely watched for inflation implications. Strong productivity could absorb wage gains without fueling prices, while weak productivity alongside rising labor costs would stoke concerns about sticky inflation. Investors will parse this release to judge how efficiently firms are managing higher wages (S&P Global).

Other Releases

The trade balance and factory orders will provide additional insights into economic momentum. Trade data will highlight tariff effects and export demand, while factory orders reveal investment appetite and supply chain conditions. Although secondary to labor reports, these measures will help shape Q3 GDP tracking and broader market positioning for September.

Fed Outlook and Investor Positioning

Markets are now pricing in a 90% probability of a September rate cut, with expectations for further easing by year-end. While this underpins equity optimism, strategists caution that historical precedent suggests markets often overreact to dovish signals, leaving them vulnerable if data fails to confirm the narrative.

Geopolitical Watchpoints

Alongside data, geopolitics could weigh on sentiment. Markets remain alert to politicized institutions and trade frictions that risk disrupting growth. The U.S.–India tariff conflict is a focal point, with escalation likely to affect supply chains and consumer prices. Any deterioration here could complicate the Fed’s easing trajectory.