Blog tagged as quantum supply chain investment

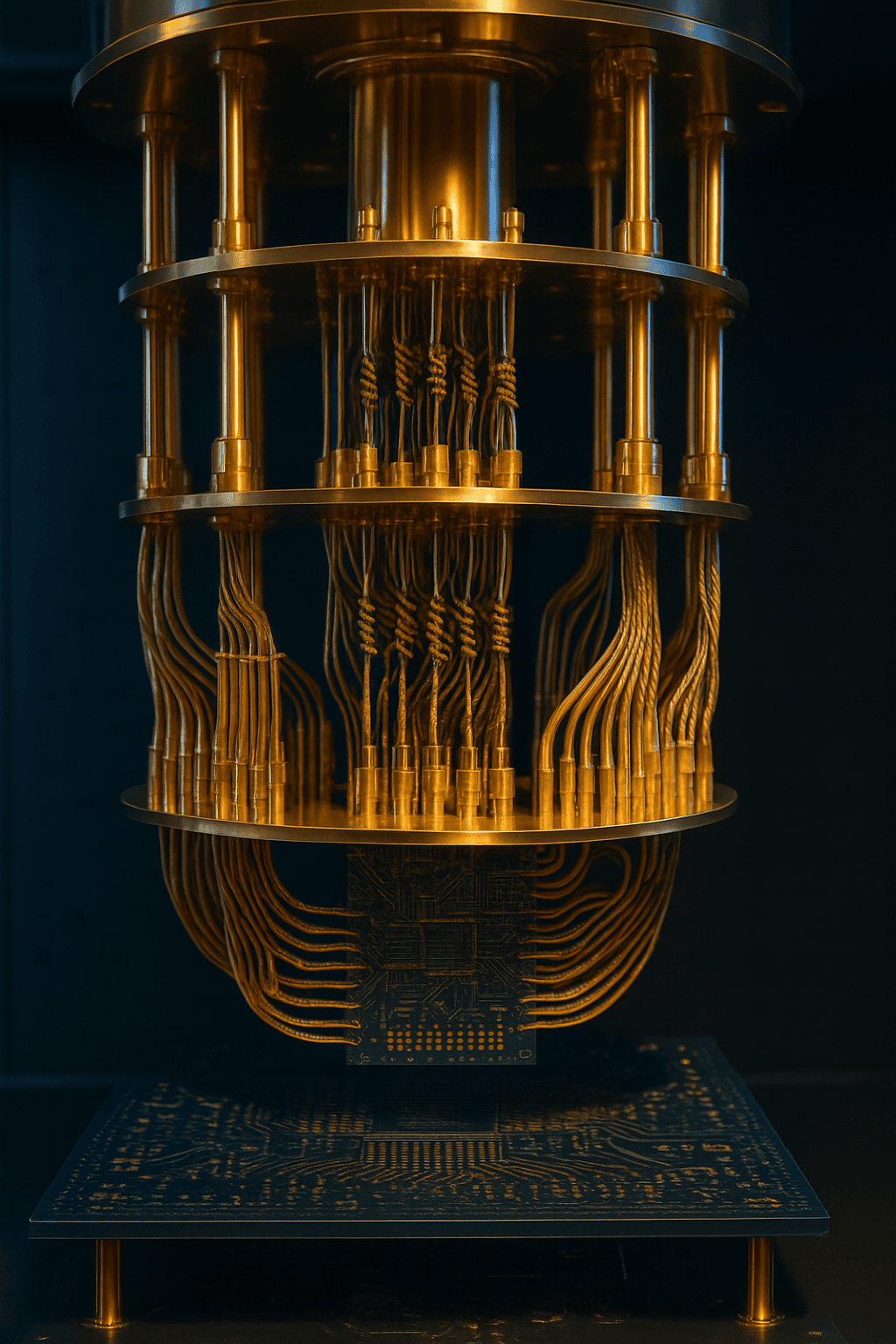

Quantum computing is shifting from hype to reality in 2025. Discover where smart investors are placing bets—from cryogenics to photonics—and how early infrastructure plays are generating real returns.

Tags :

IBM Heron chip, IonQ molecular simulation, Quantinuum system stability, Quantum computing investment outlook, cryogenic systems for quantum, early-stage quantum companies, government quantum contracts, institutional quantum investing, invest in quantum computing, lithium niobate wafers, photonic quantum computing, quantum ETF trends, quantum computing 2025, quantum computing commercialization, quantum computing funding 2025, quantum computing investment opportunities, quantum computing market trends, quantum computing stocks to watch, quantum infrastructure opportunities, quantum stock valuation risks, quantum supply chain investment, quantum technology startups, qubit technology, silicon photonics for quantum, superconducting quantum systems, trapped-ion quantum hardware

Categories :

Categories

- Uncategorized

(14)

- Market Commentary

(24)

- Advisory

(1)

Tags

- Sample

- Best Buy Stocks

- Top Growth Stocks 2024

- Stocks to Buy Now

- Best Tech Stocks to Invest In

- High-Growth Stocks to Watch

- Stock market online

- best stock to purchase now

- great stock to buy now

- doing stock

- explore stock market

- overview of stock market

- stock market

- portfolio stock market

- Cost-effective plastic production

- Custom plastic moulding

- High-precision injection moulding

- Industrial plastic moulding

- Injection moulding for automotive

- Injection moulding for medical devices

- Injection moulding manufacturing

- Injection moulding process

- Large-scale plastic moulding

- plastic injection moulding services

- Best stock analysis tools

- Best stock market research websites

- Best websites for stock analysis

- Expert stock market insights

- Institutional-grade stock research

- Investment research websites

- Real-time stock market data

- Stock market research tools

- Top stock market analysis platforms

- P/E compression

- S&P 500 P/E ratio

- S&P 500 valuation history

- economic cycle investing

- historical P/E ratios

- investing during a recession

- market multiples during recessions

- price to earnings ratio trends

- recession investing strategies

- stock market downturns

- stock market recessions

- stock valuation metrics

- trailing P/E ratio

- Calisade Capital market insights

- China retaliation tariffs

- China trade war escalation

- China-exposed equities

- Trump tariff reduction

- Trump trade policy 2025

- US tariffs 10 percent

- VIX and treasury market signals

- financial markets and tariffs

- impact of tariffs on energy sector

- investing during trade wars

- market reaction to tariff news

- market volatility and tariffs

- short-term tariff relief

- stock market rally Trump tariffs

- Advisory Solutions

- Investment Advisory Services

- Advisory services

- Advisory

- Credit

- Credit Ratings Refresher

- Debt Spiral

- Downgrade

- Downgrade Timeline

- Economic Implications

- Moody's

- Moody's Downgrade

- Sovereign Debt

- U.S.

- Big Beautiful Bill

- BBB economic impact

- U.S. fiscal policy 2025

- U.S. tax cuts 2025

- Congressional Budget Office deficit

- Trump-era tax cuts

- U.S. deficit forecast

- border security funding

- clean energy incentives rollback

- defense budget increase

- social program cuts

- Treasury yields surge

- U.S. dollar weakening

- fossil fuel industry benefits

- inflation risks 2025

- renewable energy tax credits

- FAA modernization investment

- Medicaid and SNAP cuts

- U.S. debt to GDP ratio

- economic inequality U.S.

- electric vehicle tax credit repeal

- inflation hedges gold and crypto

- interest rate forecast 2025

- investment opportunities 2025

- military spending 2025

- student loan forgiveness elimination

- value stocks energy sector

- ESG investment risks

- Reagan tax reforms

- Trump trade tariffs impact

- U.S. economic growth forecast

- U.S. social welfare cuts

- historical fiscal policy analogs

- market volatility U.S.

- post-WWII reindustrialization

- CPI

- Consumer Sentiment

- Fed rate cuts

- Federal Reserve policy

- June 2025 Consumer Sentiment

- May CPI Report

- May PPI Report

- PPI

- U.S. macroeconomic releases

- University of Michigan Sentiment

- bond market volatility

- consumer confidence

- consumer inflation

- core CPI, headline CPI

- core goods inflation

- disinflation

- economic indicators

- front-end yield curve

- growth equities

- inflation data

- inflation expectations

- inflation indicators

- inflation outlook

- inflationary pressure

- long-duration assets

- long-term inflation expectations

- macroeconomic volatility

- producer inflation

- services inflation

- shelter inflation

- short-term inflation expectations

- soft landing narrative

- tariff impact

- yield curve repricing

- rate-sensitive sectors

- BBB bill

- Gilded Age wealth gap

- K-shaped recovery

- Medicaid funding

- Reagan tax cuts

- U.S. tax cuts

- Wall Street vs. Main Street

- clean energy cuts

- defense sector stocks

- electric vehicle tax credits

- energy costs

- food price riots

- fossil fuel subsidies

- healthcare affordability

- import taxes

- income inequality

- inflation impact

- interest rate pressure

- market volatility

- rising tariffs

- short-term bonds

- solar energy policy

- two-speed economy

- AI technology investments

- economic policy impact

- economic positioning frameworks

- global diversification

- hedging strategies

- historical policy analogs

- infrastructure stocks

- institutional investor strategy

- ong-term growth risk

- premium macro research

- social instability risk

- stock market risks

- Main Street vs Wall Street

- S&P 500 analysis

- US GDP consumer spending

- US economy 2025

- US housing affordability crisis

- consumer confidence decline

- consumer spending trends

- credit card delinquencies

- global capital flows

- household debt crisis

- housing market warning

- inflation impact on economy

- investor sentiment 2025

- mega cap stocks earnings

- money market reallocation

- mortgage rates 2025

- pricing power in recession

- real estate market 2025

- resilient corporate earnings

- retail spending slowdown

- rising housing inventory

- risk-on investing trend

- stock market disconnect

- stock market outlook

- stock market vs economy

- tech stock dominance

- wealth effect and home equity

- Wall Street optimism vs reality

- economic indicators flashing caution

- equity market future outlook

- labor market slowdown risk

- BBB bill economic impact

- CPI data 2025

- Fed communications

- Fed hawkish stance

- Fed interest rate outlook

- Israel-Iran conflict

- June 2025 market update

- Middle East crisis 2025

- Strait of Hormuz tension

- Tehran nuclear escalation

- Tel Aviv missile strike

- U.S. GDP divergence

- U.S. labor market softening

- bond yield sensitivity

- central bank response

- commodity price surge

- defensive sector stocks

- economic crosscurrents

- energy market shock

- energy price inflation

- equity market response

- fiscal stimulus impact

- geopolitical investing strategy

- geopolitical market volatility

- global supply chain risks

- global trade disruption

- inflation pressures

- investor risk appetite

- macroeconomic uncertainty

- monetary policy tightening

- oil supply disruption

- real assets investment

- safe-haven assets

- stagflation risk

- two-track recovery

- Brent crude price forecast

- CAD strategy under inflation

- FOMC policy war impact

- Fed inflation outlook June 2025

- Israel–Iran war market impact

- Strait of Hormuz oil supply risk

- consumer inflation oil prices

- defense stocks rising

- energy market disruption

- equity outlook Middle East conflict

- geopolitical risk 2025

- gold vs equities war

- inflation vs interest rates 2025

- macroeconomic scenarios 2025

- oil prices Middle East conflict

- recession risk geopolitical events

- safe haven assets gold dollar

- stagflation risk global markets

- stock market volatility war

- travel sector downturn oil

- Christopher Waller July rate cut signal

- Fed Governor Cook inflation comments

- Fed monetary policy June 2025

- Fed rate hike July 2025

- Federal Reserve interest rate decision

- Iran nuclear site airstrike news

- Middle East conflict market reaction

- Powell tariff inflation statement

- Trump Iran bombing update

- US GDP Q1 revision

- US consumer sentiment index June 2025

- US tariffs inflation impact

- central bank response to war

- core PCE price index forecast

- durable goods orders May 2025

- geopolitical risk market strategy

- how tariffs affect US inflation

- inflation vs rate cuts 2025

- investing during geopolitical tension

- investment strategy under inflationary pressure

- jobless claims and Fed policy

- market outlook June 2025

- market volatility Fed inflation

- oil futures surge June 2025

- oil prices rise Iran attack

- stock market and oil prices

- Brent crude price forecast June 2025

- Christopher Waller Fed statement

- FOMC inflation concerns

- Fed Governor Lisa Cook speech

- Fed interest rate outlook July 2025

- Federal Reserve rate decision June 2025

- Iran nuclear strike Trump news

- Iran retaliation threat market impact

- Israel Iran war market impact

- Powell tariff inflation comments

- Richmond Fed manufacturing index

- US Q1 GDP final estimate 2025

- US durable goods orders May 2025

- US economy and global conflict

- US tariffs inflation impact 2025

- University of Michigan consumer sentiment June 2025

- WTI oil futures surge

- core PCE inflation data May 2025

- defense stocks rising Iran war

- energy sector volatility 2025

- geopolitical risk and markets

- how tariffs affect US economy

- interest rate cut July 2025 forecast

- investing during Middle East crisis

- market volatility this week

- oil price spike Iran conflict

- 2025 defense realignment

- AI targeting systems

- East Asia defense spending

- Indo-Pacific military readiness

- Israel Iran conflict

- Pentagon workforce reductions

- U.S. defense strategy

- advanced jamming technology

- artificial intelligence in defense

- autonomous military systems

- cyber infrastructure

- defense budget restructuring

- defense industry innovation

- defense procurement shifts

- drone warfare

- electronic warfare systems

- global conflict zones

- homeland missile defense

- long-range missile programs

- military technology trends

- missile defense economics

- naval deterrence

- prime defense contractors

- sensor-based command infrastructure

- space-based military assets

- technology-enabled deterrence

- AI-enabled autonomy

- Middle East drone defense

- air defense Europe

- autonomous defense infrastructure

- cyber defense modernization

- defense startups

- electronic warfare capabilities

- missile shield systems

- regional defense investments

- Fed interest rate outlook 2025

- NASDAQ Composite rally AI stocks

- Powell higher for longer speech

- S&P 500 record high June 2025

- US Fed dot plot 2025 update

- services sector inflation trends

- AI semiconductor demand forecast

- Fed wage growth inflation indicator

- Iran missile strike retaliation Al Udeid

- Iran nuclear facility bombing June 2025

- Micron earnings preview Q2 2025

- Nonfarm payroll forecast July 5

- Q2 2025 earnings season outlook

- US 2-year Treasury yield June 2025

- US China 10 percent tariff July 2025

- US Iran Israel ceasefire news

- US June jobs report 2025 preview

- US bond market rate expectations

- economic data impact stock rally

- geopolitical risk impact stock market

- labor market data Fed policy

- macroeconomic risks stock market July 2025

- semiconductors China exposure

- tariff impact on consumer discretionary stocks

- tech stocks AI-driven growth

- tight US labor market 2025

- 2025 budget deficit

- CBO 2025 deficit forecast

- ESG portfolio impact

- H.R. 1 tax cuts

- ICE funding increase

- Medicaid cuts 2025

- One Big Beautiful Bill

- SALT deduction cap

- Senate vs. House bill changes

- TIPS investment strategy

- Trump July 4 signing

- aerospace investment 2025

- bond yields 2025

- carbon capture incentives

- clean energy investment impact

- clean energy rollback

- defense sector equities

- equity market reaction

- federal deficit impact

- federal spending 2025

- fiscal policy market reaction

- floating-rate bond strategy

- for-profit education impact

- fossil fuel tax policy

- government budget outlook

- healthcare funding cuts

- high-income tax deductions

- hydrogen tax credit

- inflation-linked bonds

- investor portfolio allocation strategy

- long-term debt concerns

- rural hospital funding

- student loan caps

- tax reform 2025

- CPI inflation

- Inflation

- PCE inflation

- U.S. home prices

- cost of essentials

- economic stress

- housing inflation

- inflation metrics

- low-income families

- middle-income households

- owner’s equivalent rent

- real-world cost of living

- retirees fixed income

- student debt and inflation

- wage growth vs inflation

- TIPS investment

- bonds vs inflation

- commodities inflation hedge

- elite macro digest

- financial planning inflation

- forward-looking investment strategy

- gold price rally

- healthcare cost inflation

- inflation and diversification

- inflation data distortion

- inflation premium report

- inflation-proof assets

- infrastructure assets

- macroeconomic shifts

- preserving purchasing power

- real estate inflation protection

- smarter inflation investing

- sticky inflation

- tech stocks and inflation

- traditional investment strategy

- inflation and investments

- inflation-resistant assets

- pricing power stocks

- August 1 tariffs

- S&P 500 rally post tariffs

- Trump tariff letters

- US trade policy 2025

- are US markets overvalued due to buybacks

- country-specific tariff rates

- fiscal-driven market growth

- fragile market rally

- how will markets react to new Trump tariffs

- investor sentiment shift

- market volatility 2025

- mini trade deals US 2025

- new US tariffs 2025

- retail investor impact on stock market

- stock buybacks driving S&P

- tariff impact on global trade

- trade deals Trump administration

- what happens if US trade deals fall through

- what is the timeline for new tariffs in 2025

- which countries are affected by new US tariffs

- tariff-induced volatility risk

- American Express consumer credit trends

- Bank of America earnings July 2025

- Fed interest rate cut forecast

- Federal Reserve rate hike delay

- GE Aerospace earnings report

- JPMorgan earnings Q2 2025

- July 2025 earnings season preview

- Netflix Q2 2025 results

- Procter & Gamble consumer trends

- S&P 500 market outlook July 2025

- Taiwan Semiconductor Q2 earnings

- US CPI inflation report July 2025

- US bond market outlook Q3 2025

- US nonfarm payroll report July 2025

- US trade tensions Brazil Canada

- US unemployment rate July 2025

- building permits housing data 2025

- consumer sentiment index July 2025

- core inflation expectations 2025

- global supply chain risk 2025

- gold prices safe haven asset 2025

- oil prices and energy market July 2025

- retail sales report July 2025

- semiconductor earnings forecast ASML

- stock market pullback analysis

- tariff impact on stock market

- treasury yield curve strategy

- Medicaid work requirements

- disposable income

- senior tax breaks

- IBM Heron chip

- IonQ molecular simulation

- Quantinuum system stability

- Quantum computing investment outlook

- cryogenic systems for quantum

- early-stage quantum companies

- government quantum contracts

- institutional quantum investing

- invest in quantum computing

- lithium niobate wafers

- photonic quantum computing

- quantum ETF trends

- quantum computing 2025

- quantum computing commercialization

- quantum computing funding 2025

- quantum computing investment opportunities

- quantum computing market trends

- quantum computing stocks to watch

- quantum infrastructure opportunities

- quantum stock valuation risks

- quantum supply chain investment

- quantum technology startups

- qubit technology

- silicon photonics for quantum

- superconducting quantum systems

- trapped-ion quantum hardware

- CDS spreads

- ETF credit flows

- M&A banking trends

- U.S. banking landscape

- auto loan delinquencies

- bank merger policy

- banking consolidation trends

- business development companies

- capital strength screening

- commercial real estate stress

- consumer delinquencies

- credit card defaults

- credit downturn resilience

- credit market shift

- credit tightening

- financial sector 2025

- fintech lending

- fintech underwriting models

- hedge fund positioning

- insider buying activity

- loss provisions rising

- net interest income pressure

- nonbank credit providers

- portfolio leverage

- private credit funds

- private credit risks

- regional banks

- regulatory shifts

- subprime lending risk

- traditional banks

- warehouse lending risks

- banking risk indicators

- elite credit insight

- funding durability

- premium credit digest

- Bitcoin institutional adoption

- Ethereum real-world use cases

- GENIUS Act crypto regulation

- digital assets 2025

- mainstream crypto adoption

- stablecoins in global payments

- AI blockchain convergence

- Bitcoin digital gold

- Bitcoin volatility 2025

- Circle IPO 2025

- DeFi tokenization trends

- Ethereum DeFi infrastructure

- Ethereum ETF institutional demand

- MiCA regulation EU crypto

- crypto ETF inflows

- crypto investment strategies

- crypto market capitalization 2025

- crypto regulation 2025

- crypto risk profile analysis

- crypto vs gold volatility

- institutional crypto investment

- real-world asset tokenization

- stable yield crypto assets

- 10-year Treasury yield

- Apple earnings July 2025

- China tariff news

- Coinbase digital asset adoption

- EU trade framework

- Federal Reserve meeting

- July 2025 jobs report

- Microsoft and Meta reports

- Nasdaq record highs

- Powell Fed commentary

- Q2 GDP estimate

- S&P 500 performance

- Treasury bond supply

- U.S. equities

- U.S. inflation outlook

- UnitedHealth results

- Visa earnings report

- core PCE inflation data

- geopolitical market risks

- high-yield credit spreads

- interest rate decision

- market volatility July 2025

- mega-cap tech earnings

- retail sales data

- sticky inflation trends

- Housing Affordability

- Multifamily Oversupply

- Real Estate 2025

- U.S. Property Market

- Office Sector Challenges

- Retail Real Estate

- Industrial Property Trends

- Real Estate Policy

- Interest Rates and Real Estate

- CRE Market Insights

- Public Law 119‑21

- Real Estate Digest

- Real Estate Investment

- Federal Reserve July 2025

- GDP Rebound Q2 2025

- US Market Weekly Update

- Inflation Update August 2025

- Mega-cap Earnings 2025

- Global Trade Tensions

- Microsoft AI Spending

- Trump Tariffs 2025

- US Economic News

- U.S. real estate market 2025

- Federal Reserve meeting minutes analysis

- S&P 500 market trends

- US inflation data CPI PPI

- interest rate cut expectations

- labor costs productivity inflation

- retail earnings report August 2025

- stock market outlook August 2025

- tariff impact on consumer prices

- trade talks Canada EU China

- back-to-school retail sales forecast

- Federal Reserve rate cut expectations

- Geopolitical risks U.S. India tariffs

- Jackson Hole symposium Powell speech

- Nvidia earnings report 2025

- PCE inflation report August 2025

- S&P 500 weekly performance

- U.S. economic indicators August 2025

- U.S. retail earnings Walmart Target

- U.S. stock market outlook

- Weekly Market Wrap August 2025

- CPI vs PPI

- PPI as leading indicator

- corporate margin pressure tariffs

- inflation signals for investors

- producer price index vs consumer price index

- tariff effect on supply chains

- tariffs impact on inflation

- why PPI leads CPI

- U.S. stock market outlook September

- Weekly Market Wrap September 2025

- Federal Reserve September rate cut odds

- Jackson Hole Powell dovish speech

- Nvidia earnings Q2 2025

- PCE inflation data July 2025

- September jobs report 2025 preview

- Intel government stake CHIPS Act

- U.S.–India tariff conflict 2025

- S&P 500 September market rally

- Nvidia market concentration

- Apple Microsoft Nvidia index weight

- ETF flows and market volatility

- Index committee interventions

- Mega cap stocks 2025

- Nasdaq 100 weight limits

- Passive investing risks

- S&P 500 rebalancing risk

- CPI and PPI inflation data 2025

- September 2025 market outlook

- US labor market September 2025

- consumer sentiment trends 2025

- earnings season September 2025

- stock market volatility outlook

- Central Bank Credibility

- Fed Independence

- Federal Reserve

- Monetary Policy

- Political Interference

- Yield Curve

- Arthur Burn

- Bond Market

- Interest Rates

- Paul Volcker

- Stephen Miran Nomination

- Gold Hedge

- Market Volatility (MOVE Index)

- Portfolio Implications

- U.S. Dollar

- Fed interest rate decision

- Federal Reserve September 2025

- labor market slowdown

- stock market outlook 2025

- CPI and PPI data 2025

- Fed policy easing expectations

- Powell Fed meeting

- U.S. retail sales September 2025

- bond market yields